Processing payroll can be complicated sometimes and may result in some consequences if employees are not paid. Read on to find out what the functions of payroll are and how it can help your business.

What is Payroll?

Firstly, it is an essential part of every business. It is used by employers to pay their employee’s wages accurately and on time. Furthermore, alongside with paying an employee’s wages, there are a few administrative duties the payroll department must comply with.

Moreover, it helps to improve an employee’s experience at work. Therefore, employees tend to be more dedicated and motivated to their work if their wages are accurately paid.

Payroll and Human Resources

Furthermore, numerous duties are linked to Human Resources department. Therefore, both departments should liaise with each other when required to create a better understanding of their work duties.

Shared function between payroll and HR include:

- Recruitment

- Salary increase

- Bonus payments

- Benefit deductions

- Holiday leave

- Firing employees

What are the functions of payroll?

Below are 4 functions of payroll to help you have a better understanding of how it works.

Pre-Payroll

These are duties to carry out before processing the payroll, for example:

- Entering new employees into the system

- Calculating bonuses and commissions

- Student loan

- Adjusting existing employees’ payroll records

- Calculating holiday and sick pay

Wages

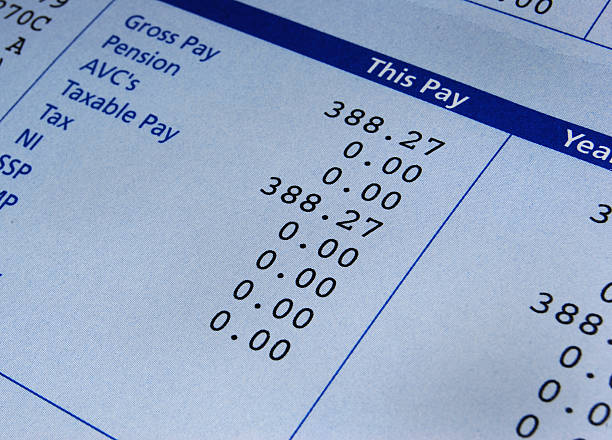

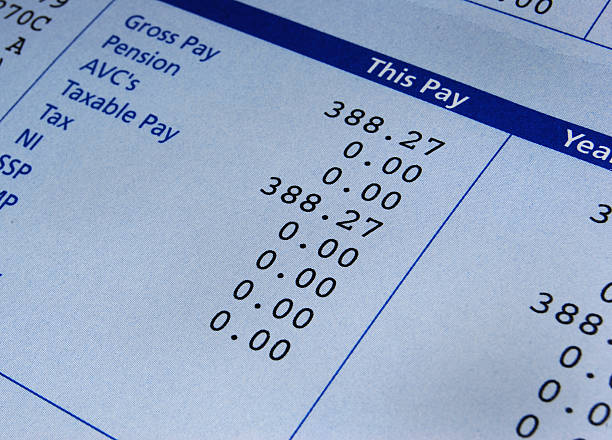

In addition to this, after processing staff time into the payroll system according to their contract, there may be slight adjustments that need to be made. These include:

- Deductions for overpayment from previous wages

- Additions to wages for bonuses or overtime

Deductions

Deductions are a significant part of functions of payroll. Ensuring the right deductions on wages are made is a legal requirement. Failure to do so will result in severe consequences. Deductions include:

- Income tax

- National insurance

- Student loans

- Voluntary amounts, such as union dues

Although pensions are a type of deduction, this is offered at the staff’s discretion and can opt out of pensions if they desire too. A back payment may be paid into the staff’s wages if they wish to opt out of their pensions.

Record keeping

Under legal requirement, there must have a record keeping system in place. This includes reporting taxes and declaration of work to HMRC.

Contact us

If you are interested and want to find more information about this, visit our page or you can contact us on sales@happiegroup.com or call on 0207 537 6631